Business Insurance in and around New Orleans

Get your New Orleans business covered, right here!

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

You've put a lot of energy into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home improvement store, a home cleaning service, an art gallery, or other.

Get your New Orleans business covered, right here!

Helping insure small businesses since 1935

Protect Your Future With State Farm

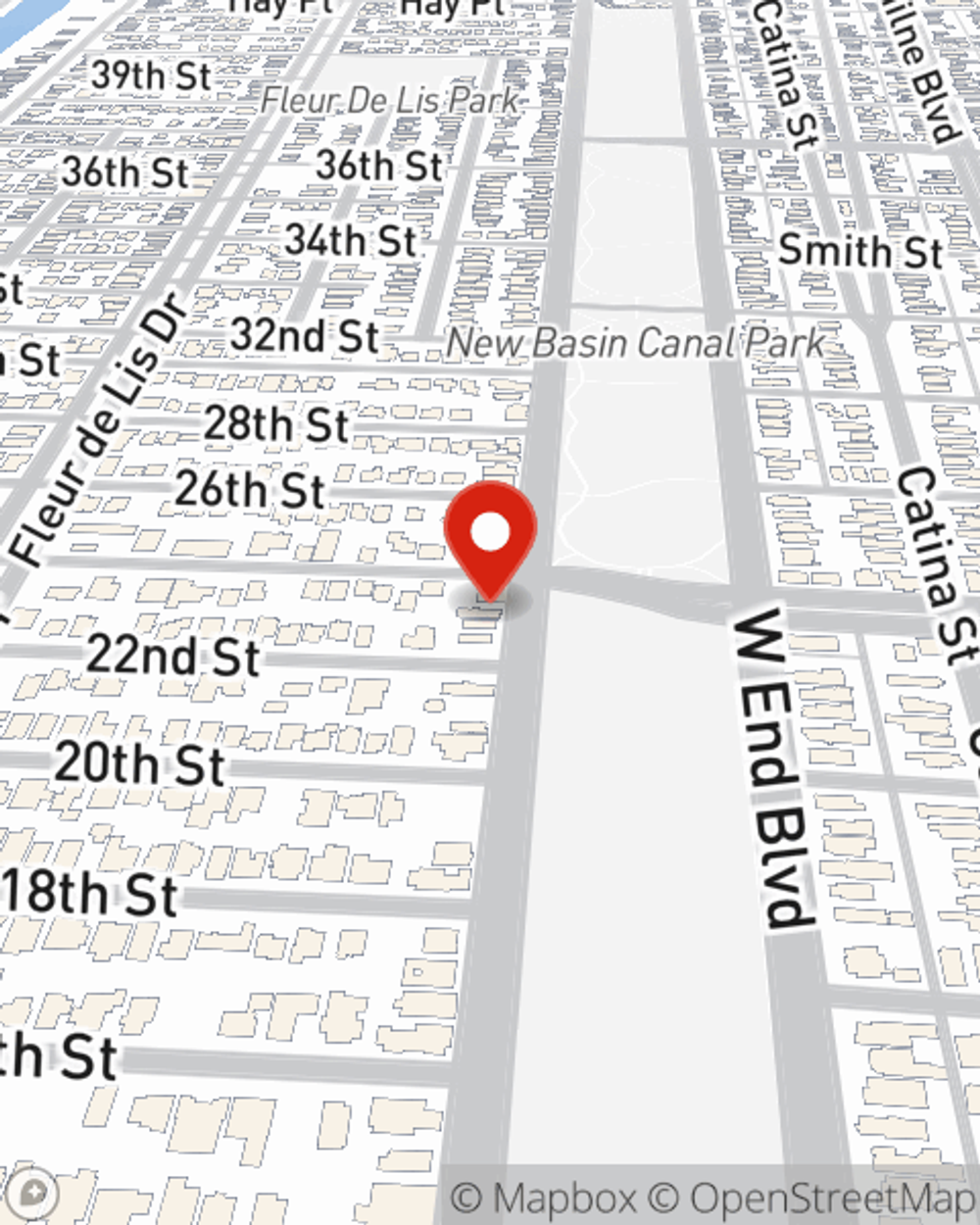

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Luke DeLouise. With an agent like Luke DeLouise, your coverage can include great options, such as artisan and service contractors, commercial auto and commercial liability umbrella policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Luke DeLouise is here to help you learn about your options. Reach out today!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Luke DeLouise

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.